Minnesota’s hemp industry faces significant challenges due to new cannabis regulations that could jeopardize local businesses. As the state prepares to roll out new licenses in the coming weeks, many entrepreneurs are growing increasingly concerned.

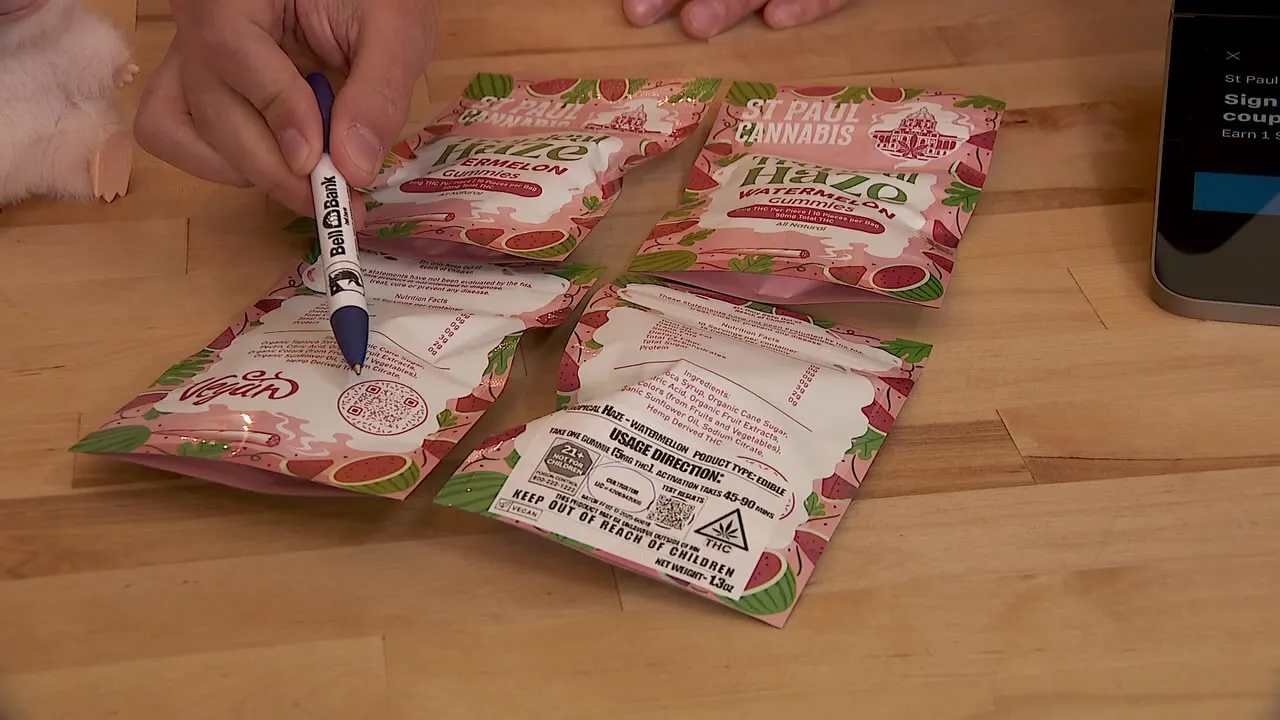

David Mendolia, owner of St. Paul Cannabis, has been successfully selling hemp-derived THC beverages and edibles for the past 2.5 years. He aims to secure a retail marijuana license while continuing to offer his popular products. However, new labeling requirements present major obstacles. Starting in October, all hemp businesses must be licensed, and the Office of Cannabis Management has mandated that product labels must include detailed information, such as license numbers for every business involved in the product’s production.

Mendolia argues that this requirement is unfeasible, especially since many hemp producers in other states lack formal licensing. He highlighted a critical issue: if he obtains his license tomorrow, all existing products in his store would technically be illegal under the new regulations. The Office of Cannabis Management has insisted that compliance with the law is non-negotiable, meaning none of the products can be sold without the appropriate licensing and labeling.

Mendolia hopes for a swift resolution to these rules, expressing concerns that he may have to discard a significant amount of inventory if no adjustments are made. “The state’s not going to change it, and the industry won’t let them either,” he stated.

Another business owner, Patty Gilk, who operates three Jes Naturals stores, also faces hurdles. Gilk has sought the best hemp products at competitive prices nationwide, but the new regulations will require her to obtain a distributor’s license costing $10,000 annually or rely on a licensed middleman. This change could drastically limit her product offerings and increase costs, making it difficult to remain competitive in the market.

Additionally, the cannabis industry is bracing for an increase in taxation. Starting in July, the tax on cannabis and hemp-derived products, including non-intoxicating CBD, will rise from 10% to 15%. Many in the industry are voicing their concerns about how these tax hikes will impact sales and overall business viability.

Overall, Minnesota’s new cannabis regulations are creating an uncertain environment for hemp businesses, raising questions about their future sustainability as they navigate these changes.