Village Farms International (VFF), a Canadian cannabis operator, is pivoting its business strategy by selling its fresh-produce unit. This move, finalized on May 30, aims to position the company as a dedicated cannabis player.

The decision follows a challenging period for the fresh-produce segment, which accounted for approximately half of Village Farms’ revenue. In the first quarter of fiscal 2025, the produce business reported a 4% year-over-year increase in sales, reaching $37.4 million. However, adverse weather conditions, specifically dust storms in March and April, severely impacted profit margins, leading to a net loss of $7.8 million for that segment, compared to a nearly break-even result from the previous year. This underperformance contributed to the overall net loss for Village Farms.

In contrast, the cannabis segment of Village Farms is experiencing robust growth. International medical cannabis exports surged by 285% year-over-year, driven by increased shipments to key markets such as Australia, Germany, and the U.K. This surge contributed to a remarkable 258% increase in net income for VFF’s Canadian cannabis operations, which reached $3 million. Additionally, the gross margin for this segment expanded to 36%, indicating improved pricing power and operational leverage.

Village Farms is maintaining its status as one of Canada’s top three cannabis producers while scaling back on lower-margin products. The company has also commenced commercial shipments to the Netherlands, generating an additional $0.5 million in revenue. Looking ahead, management anticipates that international medical cannabis sales will triple in fiscal 2025, further bolstering the company’s growth narrative. The global medical cannabis market is expected to exceed $130 billion by 2032, primarily fueled by growing acceptance for medicinal use.

As Village Farms navigates this competitive landscape, it faces challenges from industry rivals, including Aurora Cannabis, Canopy Growth, and Tilray Brands. Each of these companies is also focusing on international expansion and cost management, intensifying competition. As Village Farms gains ground in international markets, particularly in Europe and Australia, it may provoke more aggressive strategies from its competitors, possibly leading to further consolidation in the sector.

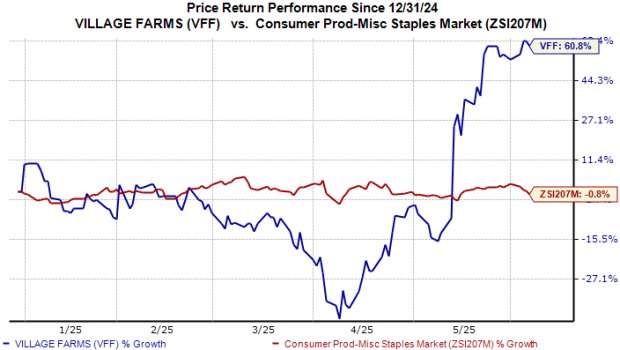

In terms of stock performance, shares of Village Farms have increased by 61% year-to-date, contrasting sharply with the cannabis industry’s overall decline of 1%. Earnings per share (EPS) estimates for fiscal years 2025 and 2026 have fluctuated over the past two months. While the company’s shift to a cannabis-focused strategy has attracted investor attention, it may be prudent for potential investors to wait for clearer earnings visibility in upcoming quarters. Current shareholders might consider holding their positions while closely monitoring the company’s quarterly performance.

This strategic divestiture marks a critical point for Village Farms as it seeks to redefine its role in the cannabis market.