Canopy Growth Corporation (CGC) has experienced a notable 39% increase in stock price over the past three months, primarily due to its aggressive restructuring aimed at reducing costs and moving towards profitability. Despite ongoing challenges with revenue trends, early indicators of improved margins and reduced debt have sparked renewed interest from investors.

In fiscal 2025, which concluded in March 2025, Canopy Growth reported a 16% year-over-year increase in net revenues from Canadian medical cannabis, reaching C$77 million. This growth was largely attributed to a larger average order size. In the fourth quarter alone, revenues from the medical cannabis segment helped mitigate declines in adult-use flower and pre-roll sales.

Internationally, Canopy’s medical cannabis sales saw a 4% decrease for the year, totaling C$39 million. This decline was driven by a downturn in the Australian market, although improved sales in Germany and Poland partially offset these losses. The company’s vaporizer division, Storz & Bickel, also contributed significantly to overall revenue. While fourth-quarter sales were weaker, the division’s full-year revenues rose by 4% to C$73 million, bolstered by strong demand for its Venty device.

Canopy Growth’s restructuring initiatives have begun to yield positive results, as evidenced by a 300 basis point increase in gross margins year-over-year and a 39% improvement in adjusted EBITDA. The company successfully cut its total debt by 49% during the same period. Looking forward, Canopy aims to expand its global medical platform and enhance profitability in Canada by concentrating on high-margin products such as vaporizers, pre-rolls, and high-THC flower. The Storz & Bickel unit is expected to support these margin improvements through operational efficiencies and the launch of new devices. Additionally, Canopy plans to achieve at least C$20 million in annual savings over the next 12 to 18 months through further reductions in selling, general, and administrative (SG&A) expenses. These steps are anticipated to bolster EBITDA in fiscal 2026 with a more streamlined, asset-light approach.

Despite these operational gains, Canopy Growth faces stiff competition from other cannabis companies, including Aurora Cannabis (ACB), Tilray Brands (TLRY), and Village Farms International (VFF). These competitors are also implementing cost-cutting measures and seeking international market growth. As Canopy expands its presence in Europe and Australia, competitive pressures from these companies are likely to increase.

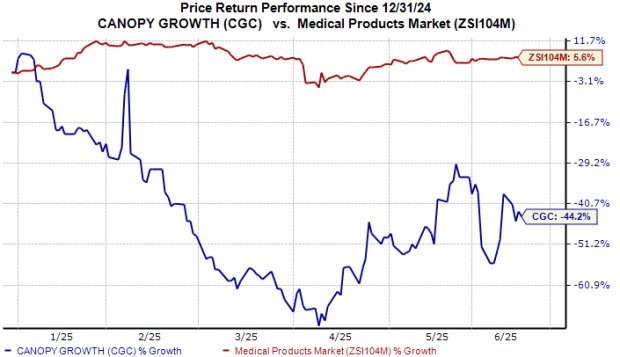

In terms of stock performance, Canopy Growth’s shares have dropped 44% year-to-date, contrasting with a 6% decline in the broader industry. Earnings estimates for fiscal 2026 and 2027 have been mixed over the last two months, reflecting uncertainty in the market.

Investors may want to wait for clearer signs of sustained EBITDA improvement before buying or increasing their holdings in Canopy Growth. Current shareholders might consider maintaining their investments while closely monitoring the company’s execution of its profitability strategy. Canopy Growth currently holds a Zacks Rank #3 (Hold), indicating a cautious outlook as it works to solidify its market position.